GBS WORLD NEWS | WEEK 3 | JUNE 2024

The annual Nexus 2024 event, held from June 12 to 13 in Jersey City, New Jersey, highlighted the significant rise of Latin America and the Caribbean in the global knowledge economy. The Americas’ Nearshore has garnered a global reputation for its value, competence, and flexibility. However, the region faces challenges, including geopolitical instability, rising costs, and increasing demand for bilingual talent. The event also focused on the impact of automation and artificial intelligence (AI) on traditional BPO/ITO delivery models. Delegates from countries such as Barbados, Colombia, Costa Rica, Jamaica, Mexico, Panama and St. Lucia (to mention a few) participated, emphasizing the region’s growing influence and the need for strategic approaches to workforce management.

The United-Kingdom-based outsourcing firm, Capita, announced plans to enhance its financial performance and cash generation. Following a £100 million cost-cutting initiative due to a cyber incident and business exits, CEO Adolfo Hernandez stated the strategy aims for 6–8% profit margins and positive cash flow by 2025. The move includes restructuring and cost reduction, shifting focus to concentrate on core segments, including public services, contact centers, and pension solutions.

Multinational tech giant Microsoft, headquartered in Redmond, Washington, is outsourcing its AI R&D to OpenAI. However, the partnership between the two key players in AI development may inadvertently be helping Google in its AI advancements, according to Todd McKinnon – a key voice in the tech world and CEO of the cybersecurity firm, Okta. Though OpenAI’s ChatGPT no doubt propelled the usage of generative AI across the globe, Google, which retains in-house R&D, was initially responsible for the research on transformers (deep learning models), which power generative AI. McKinnon suggests that Microsoft “could end up as a consultancy for OpenAI,” leaving more room in the competitive AI field for Google to step up.

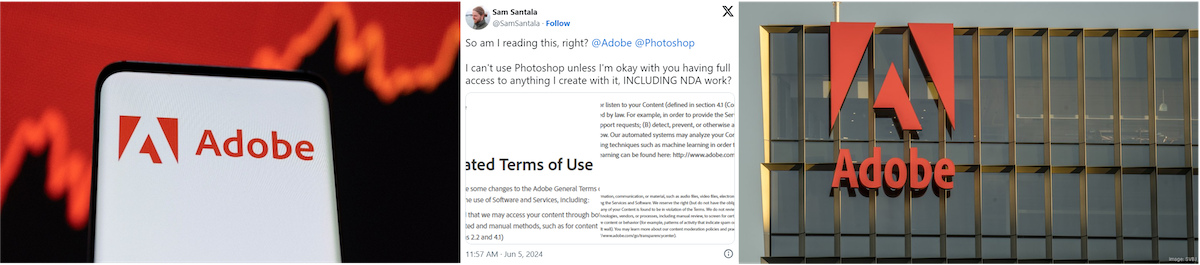

The global computer software company Adobe, headquartered in California, is under fire after its revised terms of use incited backlash from creatives. Users took to social media to share their shock that the company can now access and use their work, even under non-disclosure agreements (NDAs). The terms allow Adobe to use customer content for purposes like training its AI image generator, Firefly. Despite reassurances from Adobe’s chief product officer that customer data isn’t used for AI training, many users are distressed about privacy and intellectual property issues.

The global computer software company Adobe, headquartered in California, is under fire after its revised terms of use incited backlash from creatives. Users took to social media to share their shock that the company can now access and use their work, even under non-disclosure agreements (NDAs). The terms allow Adobe to use customer content for purposes like training its AI image generator, Firefly. Despite reassurances from Adobe’s chief product officer that customer data isn’t used for AI training, many users are distressed about privacy and intellectual property issues.

In South Africa, the KwaZulu-Natal (KZN) South Coast is emerging as a prime location for GBS/BPO investments. BPESA CEO Reshni Singh highlighted the region’s potential, noting its attractive property sector, talent pool, and business-friendly environment. With 6,018 new BPO jobs created in the country between October and December last year, 39% of new GBS/BPO jobs in South Africa located in KwaZulu-Natal, the South Coast is poised for significant growth in the sector.

A recent report by global market research firm, Technavio, revealed that the Human Resource Outsourcing (HRO) market is set to expand by US$13.3 billion from 2024 to 2028. Driven by digitization and recruitment analytics adoption, the market is expected to grow at a 5.28% CAGR. Despite the benefits of streamlined processes and cost efficiency, challenges such as dependency on outsourcing agencies and data security remain significant hurdles for businesses.

Also in global reports, the market research company, Forrester, has released its Forrester Wave™ report for Q2 2024. The report evaluates leading Customer Journey Orchestration (CJO) platforms, highlighting the integration of new criteria such as predictive and generative AI, journey hierarchy, and business operations intelligence. The report underscores the importance of data fusion, advanced AI integration, and comprehensive journey metrics to enhance customer experience and operational efficiency.