Enterprise Outsourcing Pain Points, Habits, and Selection Criteria

In the dynamic realm of the business process outsourcing (BPO) industry, the 2025 Global Voice of the Buy-Side Client Survey has emerged as a compass to guide businesses through the intricate landscape of outsourcing and offshoring.

This blog piece delves into some key findings from the survey, spotlighting enterprise pain points, sourcing habits, and the pivotal criteria shaping their choice of service providers. From navigating frustrations to deciphering the blueprint of the ideal provider, explore how these insights redefine customer-centric strategies and drive businesses towards success.

Buyer Pain Points and Frustrations

The survey cast a spotlight on the challenges and pain points that enterprise executives encounter as they strive to identify the ideal sourcing locations. These insights provide a roadmap for businesses seeking to refine their strategies and better cater to the nuanced needs of their leadership teams.

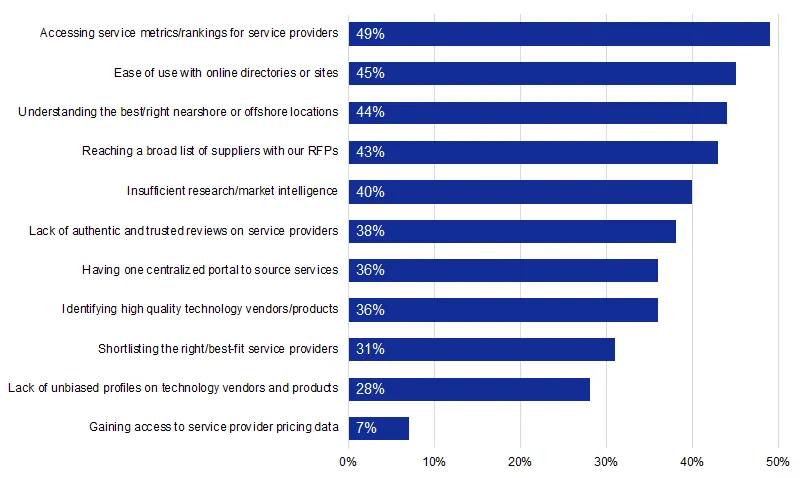

The main pain points that enterprises across the globe experience in the service-provider-selection process were identified, and a cross-market average was obtained:

Key themes can be drawn from these findings:

Key themes can be drawn from these findings:

1. Accessing Service Metrics/Rankings: Enterprise executives who outsource services are on a quest to identify high-quality suppliers that resonate with their requirements and deliver innovation. The survey underscores the scarcity of unbiased profiles and authentic assessments for these suppliers, leaving enterprises to grapple with uncertainty in an era that demands technological excellence.

2. Leveraging Online Directories: The digital age has ushered in an abundance of online directories. However, ease of use, authenticity, and the depth of information provided by these platforms emerge as critical factors. The survey underscores the need for intuitive interfaces that empower enterprises to efficiently navigate through the expansive sea of choices.

3. Understanding the Right Nearshore or Offshore Locations: For enterprise executives, this decision is not just about geographical proximity, but a delicate balance between cost-efficiency, cultural alignment, and accessibility.

4. A Singular Hub for Sourcing Services: Enterprise buyers are increasingly searching for a centralized platform – a ‘one-stop-shop’ where they can seamlessly and conveniently explore and source a diverse spectrum of services. This reflects a need for a streamlined approach, where they can effortlessly access a broad array of suppliers, reducing the strain of their sourcing efforts.

5. Accessing Comprehensive Information: The absence of comprehensive data can hinder effective decision-making. The survey highlights the struggle enterprise executives face in accessing vital service metrics and pricing surveys. Authentic reviews on service providers are equally scarce, leaving enterprise buyers grappling with uncertainty as they seek dependable partners who align with their visions.

6. Insufficient Research and Market Intelligence: Sound decisions hinge on robust research and market intelligence, yet the survey reveals a persistent challenge: inadequate insights. Without a comprehensive understanding of the market landscape, enterprises risk making sub-optimal choices that may not align with their strategic objectives.

7. The Art of Shortlisting: A daunting aspect of the sourcing journey is shortlisting the right service providers from an extensive array. The survey highlights the challenges in this curation process, where businesses aim to strike a balance between diverse offerings and pinpointing providers that align with their unique demands.

Source: GBS.World 2025 Global Voice of the Buy-Side Client Survey

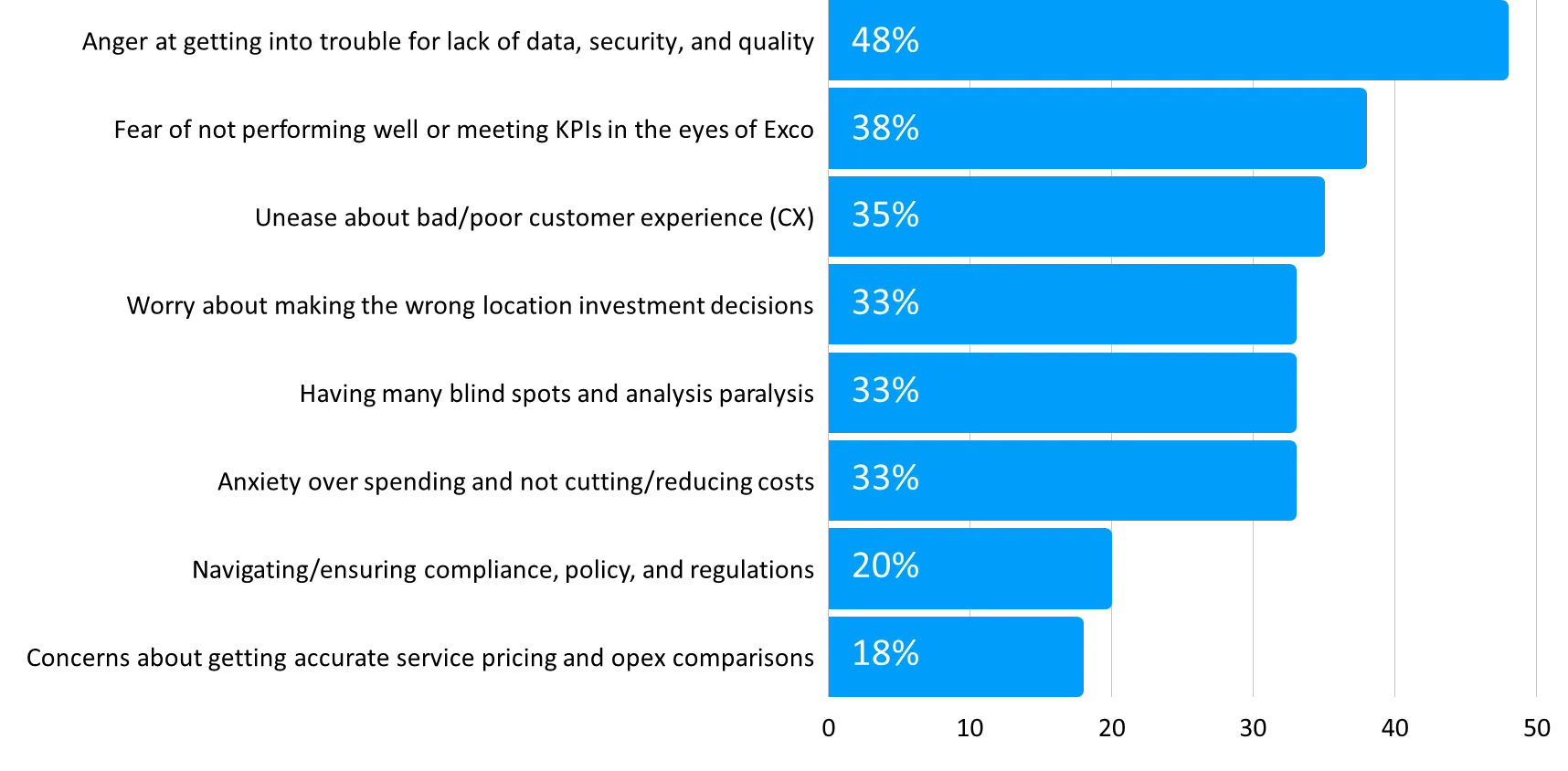

Also identified in the survey are key business frustrations and irritations experienced by enterprises. The main issues experienced were anger at getting into trouble for lack of data, security, and quality (48%), fear of not performing well or meeting KPIs (38%), and unease about poor customer experience (35%).

Sourcing Habits and Criteria

Sourcing Habits and Criteria

In the journey to select suitable service providers and establish fruitful partnerships, enterprise buyers employ a diverse range of strategies that mirror the evolving dynamics of the modern marketplace.

The survey unveiled some of the key tactics that enterprises employ when sourcing business services, and the following key themes were present:

1. The Power of Buyer Guides and Search Engines: These resources provide a gateway to a wealth of information, allowing enterprises to better navigate the complex landscape of service providers.

2. Harnessing the Expertise of Consultants and Advisors: The survey underscores the pivotal role played by consultants and advisors in the sourcing process. Their insights and recommendations offer a roadmap, guiding enterprises toward the right service providers and facilitating informed decisions that align with business objectives.

3. The Online B2B Marketplace Advantage: Online B2B marketplaces have emerged as an invaluable resource, acting as a meeting point for enterprise buyers and sellers across industries. These platforms streamline the sourcing process, offering a comprehensive ecosystem where businesses can explore a wide range of service providers under one digital roof.

4. Networking and Referrals: The survey highlights how enterprise executives tap into their professional networks, leveraging firsthand experiences and recommendations to unearth service providers that meet their specific needs.

5. Unveiling Insights through Industry Media: Industry media sites serve as a valuable source of insights for enterprise executives, offering a window into the latest trends, market dynamics, and potential service providers. By keeping a finger on the pulse of industry developments, enterprise leaders arm themselves with knowledge that informs their sourcing decisions.

6. From Expressions of Interest to RFPs: Invitations to submit expressions of interest and requests for proposals (RFPs) mark significant milestones in the sourcing journey. These formal invitations allow enterprise buyers to gauge the capabilities of potential service providers and determine alignment with their requirements.

Source: GBS.World 2025 Global Voice of the Buy-Side Client Survey 7. The Wisdom of Analysts, Advisors, and Industry Events: Analysts and industry advisors hold a wealth of insights, offering enterprise leaders a holistic perspective on potential service providers. Events and webinars, organized by industry experts, serve as platforms for education and networking, enabling enterprises to make informed choices.

8. Recommendations: Amidst the digital landscape, recommendations from colleagues continue to hold sway. The survey highlights the enduring influence of personal endorsements, showcasing the weight of trust when it comes to selecting service providers.

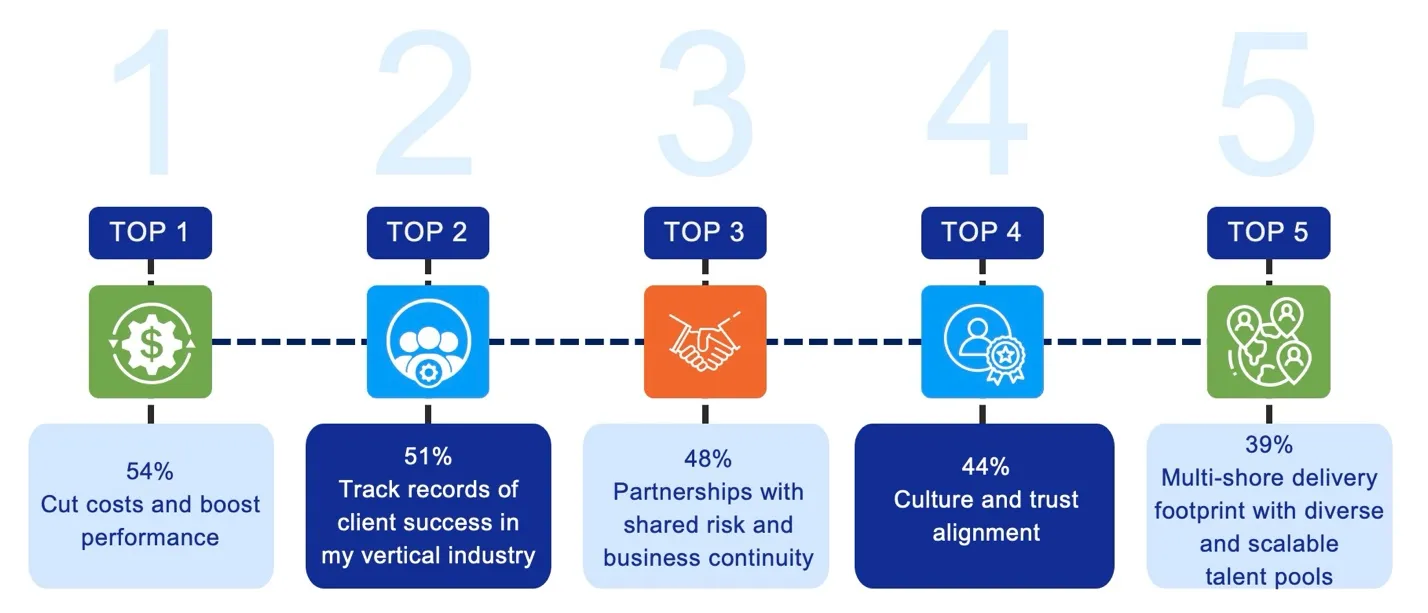

With these habits in mind, enterprise leaders also identified the main criteria they use when selecting, and continuing to work with, a CX/BPO service provider. The following were identified as the top five areas that enterprise leaders prioritize:

Elevating Sourcing Excellence: Regenerating Buyer–Seller Synergy

The revelations of the 2025 Global Voice of the Buy-Side Client Survey have illuminated the dynamic landscape where enterprise pain points intersect with sourcing strategies.

Thanks to these insights into the challenges that enterprises face and the strategies they employ, businesses now possess a roadmap to reshape their approaches and craft solutions that resonate deeply with their target audience.

In this era of rapid change, the journey towards sourcing excellence is a continuous one. By embracing these insights, businesses can propel themselves toward a future where buyer–seller synergy isn’t just a goal, but a reality.

Source GBS.World 2025 Global Voice of the Buy-Side Client Survey

Key themes can be drawn from these findings:

Key themes can be drawn from these findings: Sourcing Habits and Criteria

Sourcing Habits and Criteria